Personal Finance Tips Every Business Owner Should Know

Guest post by Michael Deane

You may excel at managing your business and knowing where every dollar goes but you might not think much about your personal finances. Maybe it’s simply not something you enjoy doing, unlike running your business, which is your true passion.

We understand. In fact, many home business owners are in the same position. This is because the line between your business and your personal life is easily blurred when you work from home. But keeping your personal finances in good shape is a priority if you want to avoid trouble later. Financial management is one of the top skills every business owner should develop before starting their business.

If you’re unsure how to do it, these personal finance tips for every business owner should help.

Never Mix Personal Finance With Your Business Finance

We start with the most obvious tip precisely because business owners make this mistake all too often. Mixing personal and business finance almost never ends well.

Separating your personal and business finances requires setting up separate bank accounts, keeping business expenses separate from your own, giving yourself a fixed salary every month, etc.

This may sound difficult when you run a home-based business and you basically live and work in the same place. But even so, you should try to separate the two.

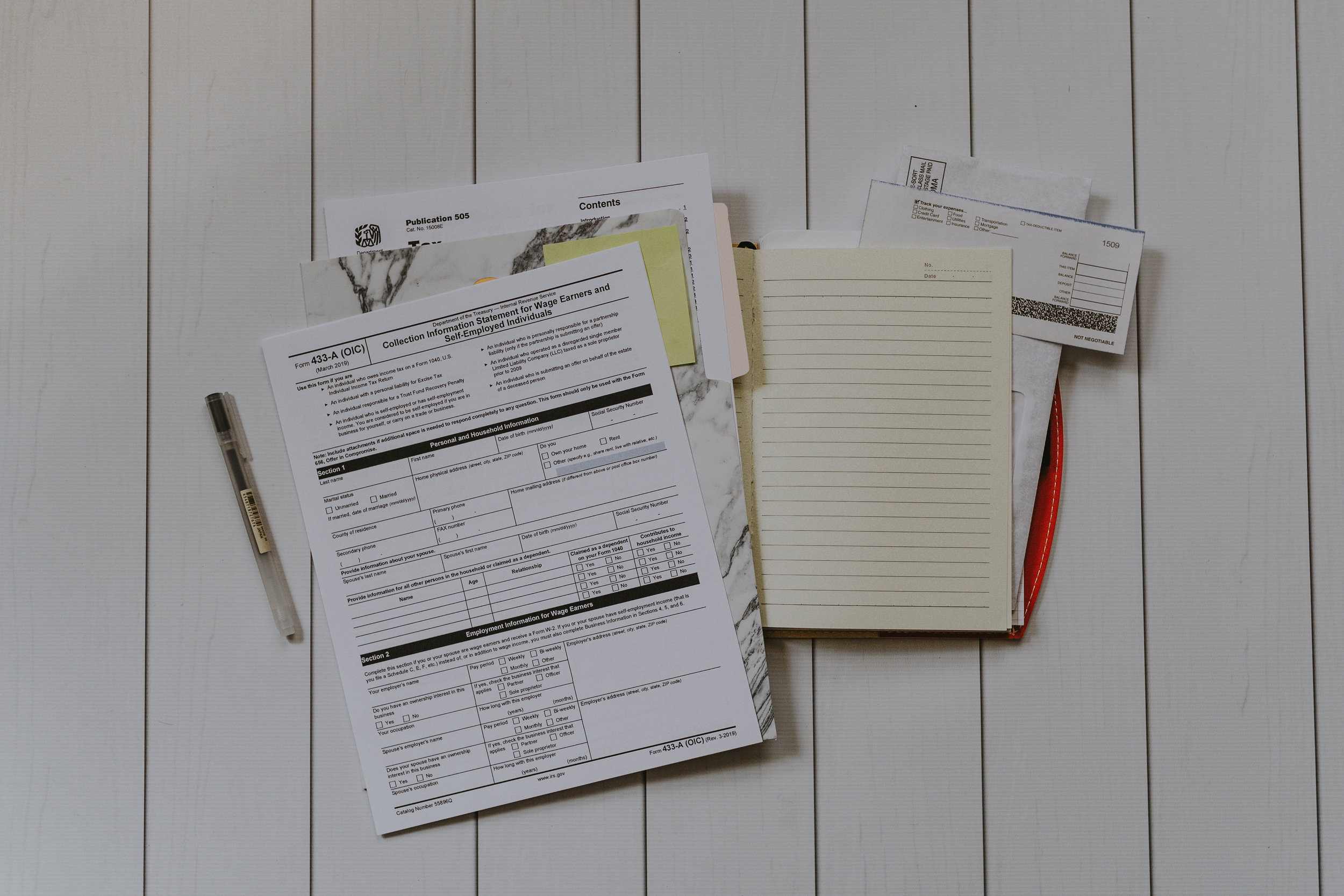

The benefits of keeping your finances separate go far beyond tax purposes, although this is reason enough to stick to this rule. You can take advantage of various tax deductions to reduce the tax bill for your business. Additionally, you can write off most of your spending as business expenses.

Now imagine the added stress of having to go through all the expenses, personal and business, trying to calculate your taxes? This would take significantly more time. Keeping your business expenses separate makes everything much easier. Also, if you happen to be audited, the authorities will audit both your records: personal and business. Naturally, you want to avoid this.

Give yourself a fixed salary every month, even if you are running an online business, and don’t use your business credit card for small personal purchases now and then. You’ll be thankful later.

Manage Your Spending

Unless your business is bringing in millions every year and finances are the least of your worries, you need to be careful with your spending. Even though you run a business and may want to keep certain appearances, you should really try to keep track of how much you spend and where your money goes.

Creating a personal budget helps. It enables you to live within your means and gives you structure. You know how much you make every month, you know how much your mortgage and bills are, and how much you can splurge on luxuries. Clear and simple, no philosophy about it.

You’re already managing a remote team so you’re saving money on rent and office supplies. Think about how else you may cut your spending. Perhaps quit that gym you paid for in advance if you don’t really use it. The idea is to see whether you’re spending more than you earn every month and how to remedy that. Putting everything on paper gives you perspective.

There are countless practical ways to manage your spending, such as budgeting apps. You can download one to help you track your expenses. Many of them are completely free so take your pick.

Create a Strategy for Your Debt

If you’re in debt, you should tackle that as soon as possible. Debt can prevent you from meeting your financial goals and can really hinder both your personal and business efforts. As long as you’re in debt, you can’t focus on your retirement plans, purchasing a bigger home for your family, etc.

Choosing a debt strategy is extremely helpful in this situation. For example, you should strive to make at least minimum payments towards your debts every month, regardless of how small a payment we’re talking about. As you pay off a debt, you can use that money and put it towards your next bigger debt. This method is called a debt snowball strategy.

This is another reason why budgeting is such a smart choice. Include your debt payments into your personal monthly budget to ensure that you make payments toward the debt every month.

Seek a Financial Professional

You may think that hiring financial professionals is reserved for big companies and not small home-based businesses. But if you’re really not eager to delve deeper into money management or you’re simply overwhelmed, you can skip our tips and talk to a professional. They’re likely to give you some guidance when it comes to managing your finances and you’ll be able to get confirmation that you’re doing everything right.

One purposeful talk with a financial advisor can make a huge difference in your life. It’s a small investment compared to the benefits you will get.

Start an Emergency Savings

We all might be one emergency savings away from a disaster. There have been too many examples of failed businesses and bankruptcies all because these business owners and individuals didn’t bother to set up an emergency fund. Or they believed they couldn’t afford it.

But given the importance of having emergency savings, you can’t afford to not have it.

You might be a huge medical bill away from bankruptcy. We need not look further for examples than what’s going on right now in the world. The COVID-19 pandemic has swept the world leaving countless small businesses with their doors shut and even managing to jeopardize some of the big names.

If your business happens to fail and you don’t have any savings, you’re in trouble. However, if you manage to save at least three months’ worth of expenses, you’ll have the time to think about your next move without pressure.

About the Author

Michael has been working in marketing for almost a decade and has worked with a huge range of clients, which has made him knowledgeable on many different subjects. He has recently rediscovered a passion for writing and hopes to make it a daily habit. You can read more of Michael's work at Qeedle.