How to Manage Your Finances as a Freelance Writer

It’s often said that freelancers don’t like doing the boring stuff. While it may be true, unfortunately, for the freelance writer, putting off the task of money management is not an option if you want to keep bringing in the cash and stay on top of your financial game. Managing your finances can be daunting at the best of times. Still, don’t let these stresses keep you from achieving your freelancing goals! Here are some tips to help you get your finances in order, from creating a savings account to saving on your taxes.

Identify your regular expenses

To stay financially fit, you need to know what most of your money is being spent on every month and trim the fat.

The most common expenses are:

Rent or mortgage costs

Phone bill

Car note

Insurance

Utilities

Don’t forget to figure out your business expenses! These include:

Internet

Office supplies

Website hosting

Domain costs

Now that you know what you’re spending, trim the fat. The less you pay in bills each month, the less you will be stressed during lean times in your business. Compare the prices of utility companies, website hosting, insurance, and internet services to see if you can find a lower-cost provider. Then, consider refinancing your cars and mortgages to find a better interest rate to save even more in the long-term.

Once that’s done, look into additional expenses, such as eating out, going to the movies, or going out to get a coffee every morning. Are there things that could be limited or done at home to save money?

Set goals for your finances

Any successful business will need to set and meet financial goals. The same goes for freelance writers, too. To start out, figure out these three numbers:

How much money is needed to pay all the bills

How much money is needed to pay the bills and have a little extra to play with

How much money is needed to live the dream life

Once all of these numbers have been identified, you can plan on how much work you’ll need to get to achieve your financial goals.

How do you determine your rates? Here’s a good guide to help you figure it all out.

Save smart

When squirrels hunt for acorns and such during the fall, they will take the nuts and bury them away to come back to later when food runs out. This is what we should be doing with our finances. Having enough money stashed away to cover any incidentals, or as an ‘emergency fund’ is just smart, especially if you are a freelance writer.

Freelance writing is unpredictable. The ‘feast and famine’ nature of the freelancing world could mean several months of drought where you can’t quite meet your financial goal for that month. With an emergency fund, you won’t need to worry about how you’re going to pay your bills and keep food on the table.

For example, on average, you make around $3,000 per month, but in August you only made $2,500, you can loan yourself $500 from your savings to cover the cost of those extra expenses. You have to keep track of what you borrow, though, and then pay yourself back when you make any money over your financial goals.

Here’s some ways to maximize your freelance profits.

Work on improving your credit score

Many personal loan calculators and banks will ask for your monthly income as part of the application process and, for us, income can be unpredictable. I’ve found that when I’m getting car loans, a good credit score can mean the difference between getting a loan and going home without a car because the banks recognize the unsabilitity of freelancing as a negative. Can’t really blame them on that one, but it means that we need to keep our credit score strong.

These are some simple ways that you can work to improve your credit score over time:

Set up an auto payment for your credit cards, so you never miss a payment- missed, or late payments will lower your credit score.

The more available credit you have, the better. Don’t be afraid to ask your credit card companies to increase your limit. An increased limit that isn’t used will make your score increase.

Pay off debt. Paying off car loans, paying your student loans, paying your mortgage, and paying down on your credit cards all make your score go up.

Pay some regular payments through your credit card, such as your phone bill and pay them back within a few days of paying your bill to bring your available balance back up.

Limit spending because you see the money is there. Credit card money is not your money to be spent but is a backup option. Budgeting properly is essential, so you don’t use your credit card as additional spending money!

Over time, you will begin to see your credit score creeping up. Here are some more tips for bettering your credit from Experian.

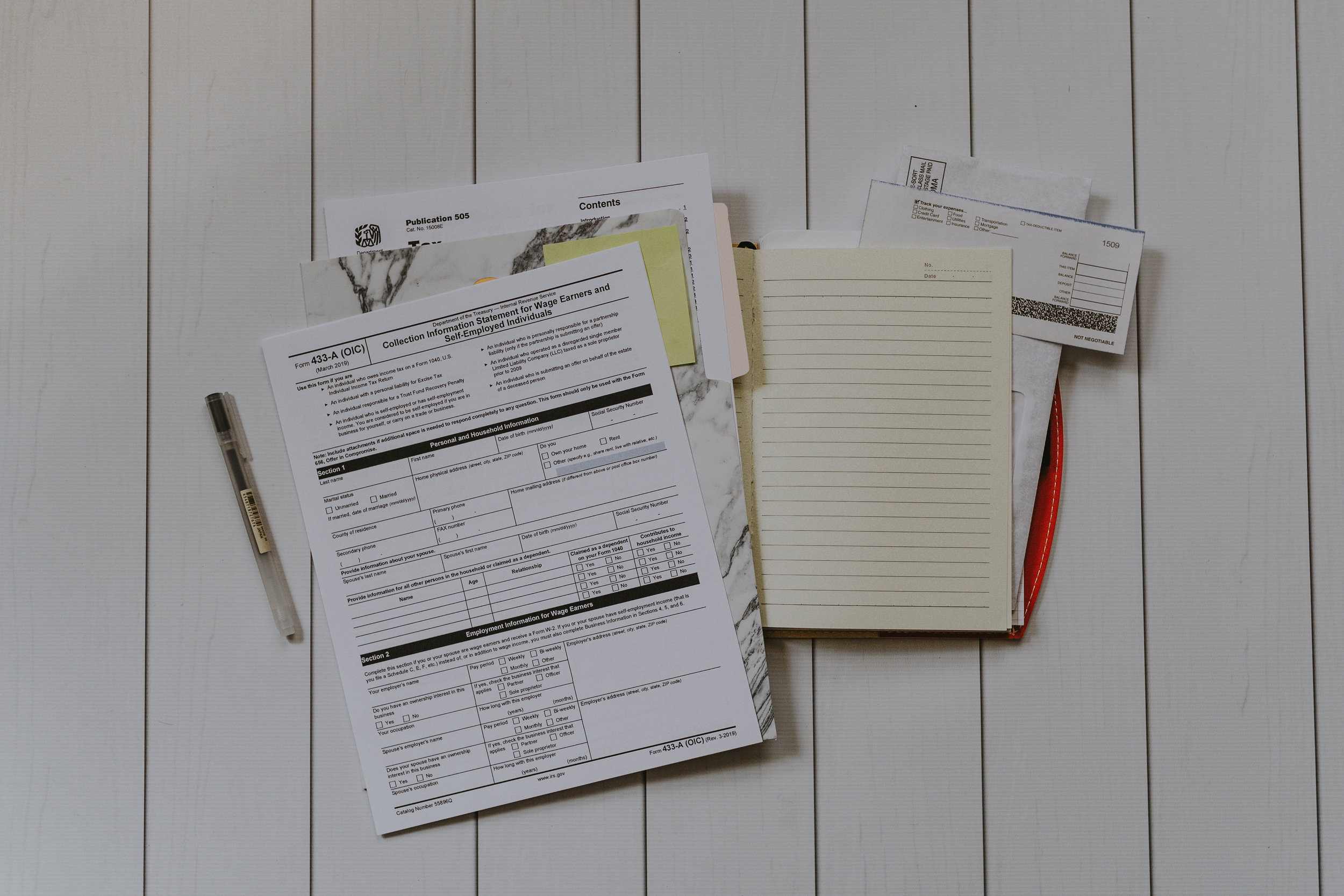

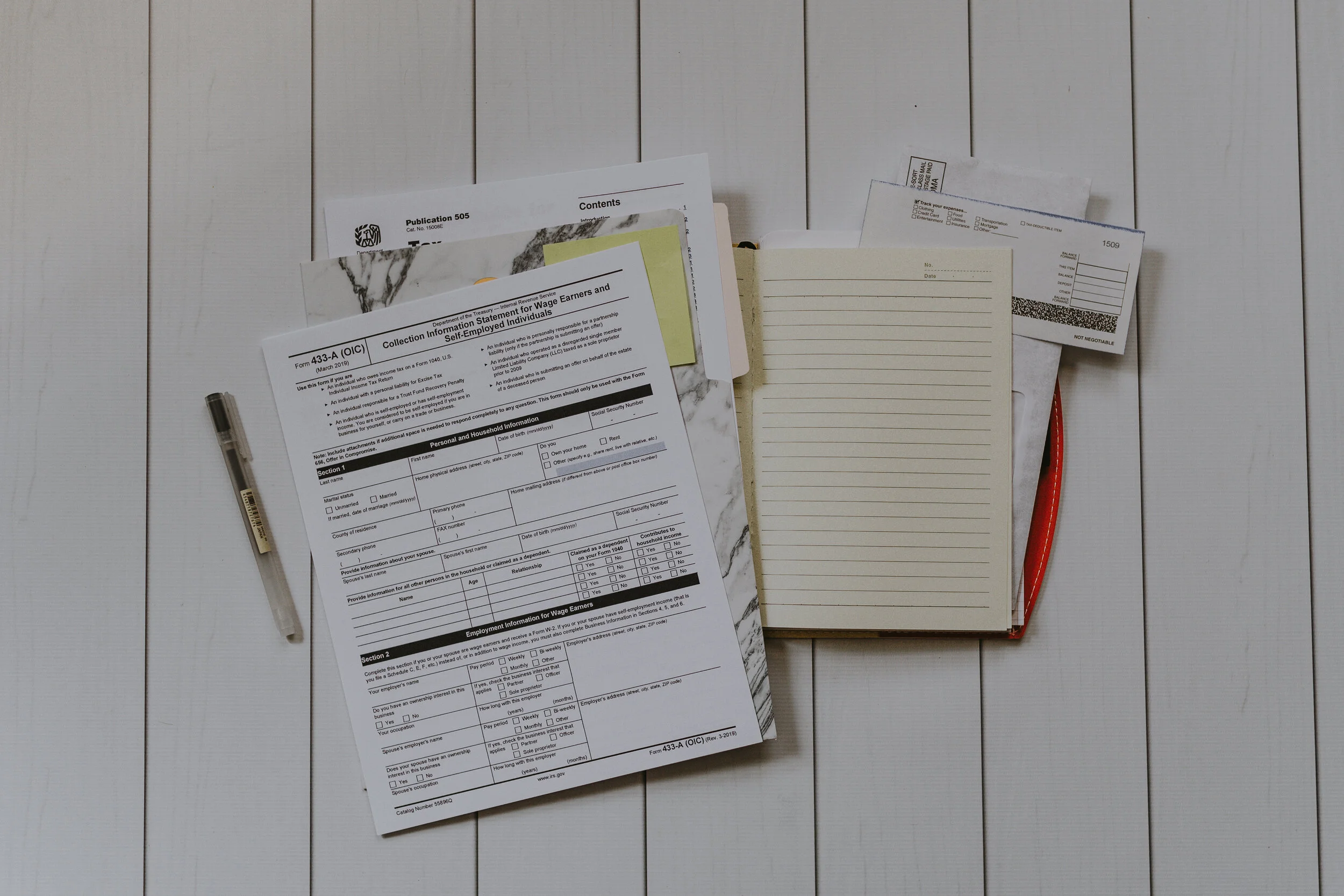

Work out deductions

Working for yourself will often mean getting the lovely surprise of being hit with that extra tax rate due to your self-employment. Stay on top of your business expenses and use them as deductions to avoid paying more in taxes than your should.

First, use a business expense tracking app, like BizXpenseTracker, Smart Receipts, or Expensify, to store pictures of your receipts, and then work with an accountant who will help you to sift through to see which purchases could be claimed as a business expenses.

You’d be surprised at how much of your spending is for legitimate business reasons! Many freelancers don’t take advantage of the fact that their mileage, internet usage, and office equipment even though all count towards tax savings!

Here are some potential deductions:

Office supplies

Clothes you buy to wear at meetings with clients

Part of your mortgage to account for your home office

Desks, office chairs, filing cabinets, and other office furniture

External hard drives, mice, keyboards, routers, and other computer equipment

Computer or laptop

Internet service

Magazines, books, and courses you use to learn about freelance writing or to manage your business

Mileage on your car used to meet with clients or to go to seminars

Website and domain hosting costs

PayPal or other money service fees

Bank fees