Blogging and Taxes- What You Need to Know

If you’ve been blogging for a little while, you might have gained the attention of various companies who are looking to offer you sponsorships. Which is amazing- earning money from a hobby is the dream! But when you start bringing in cash on a regular basis, you’re no longer classed as just a hobby blogger, and there are a few steps you’ll need to take.

Your Blog, Your Business

At the start of your journey as a blogger, you're a sole proprietor. In this setup, there's no legal distinction between you as the owner and your business (blog). As the sole proprietor, you’re personally responsible for all aspects of the business, including finances and liabilities, and have full control over decision-making. It's the simplest form of business ownership, and is often chosen by freelancers and small businesses since it requires no formal registration other than necessary licenses.

You receive all the profits, but also bear all of the risks.

Exploring the process of obtaining an EIN might be a wise step, especially if you plan to transition to a Limited Liability Company (LLC) later on. This switch influences how you report income and expenses, potentially offering personal liability protection. You might wonder how long it takes to get an EIN number, but typically, obtaining this is a straightforward process. This is something worth looking into as your business grows.

Tracking Your Income and Expenses

When it comes to taxes, one of the most important things is to maintain a clear record of what you earn and spend. Regular tracking means financial transparency, and this makes tax time a lot smoother, whether you’re doing it yourself or using an accountant. Using software is probably the quickest and easiest, so do some research and choose one that you like the look of. Make sure to keep things like receipts, invoices, and contracts in order, too.

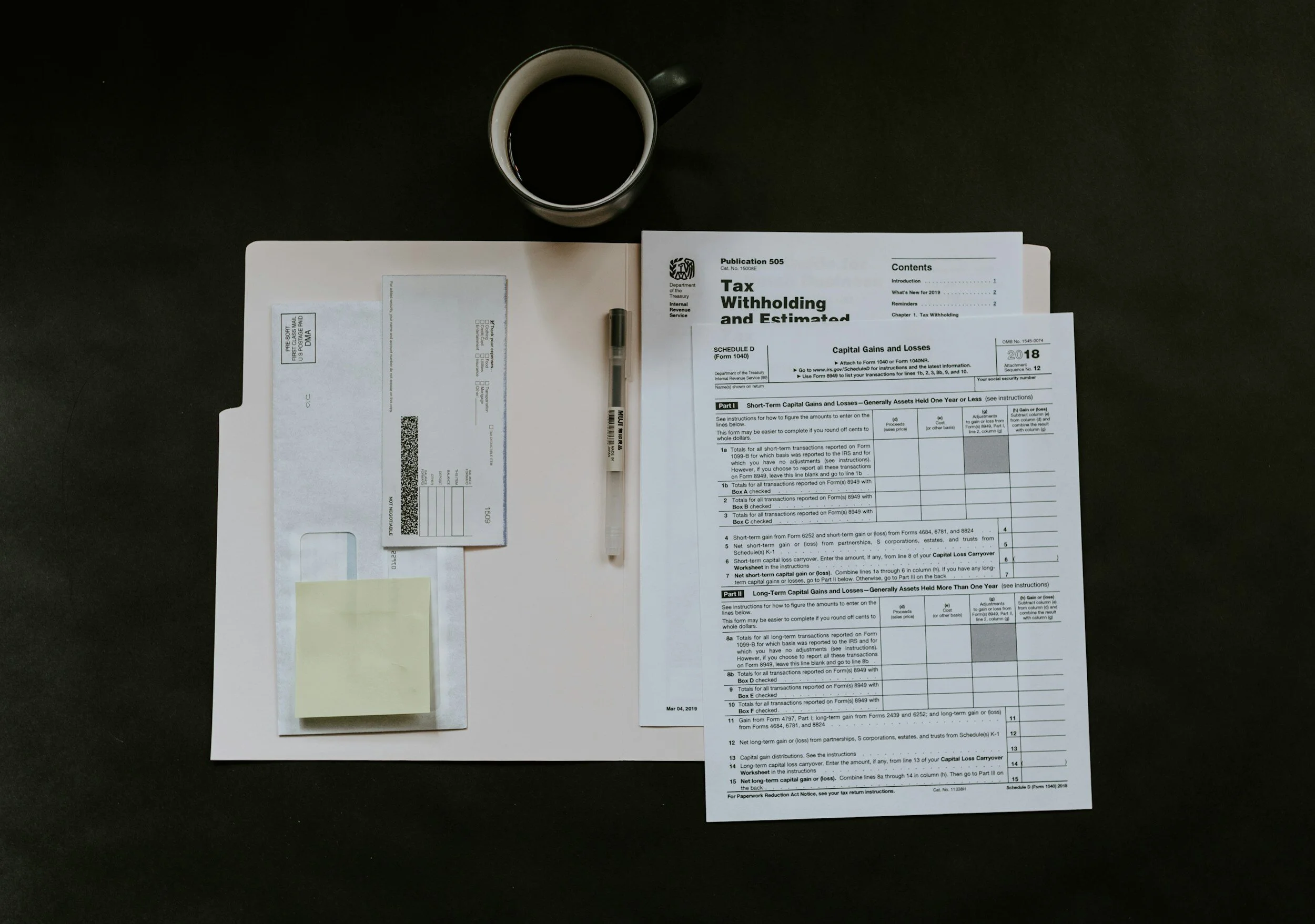

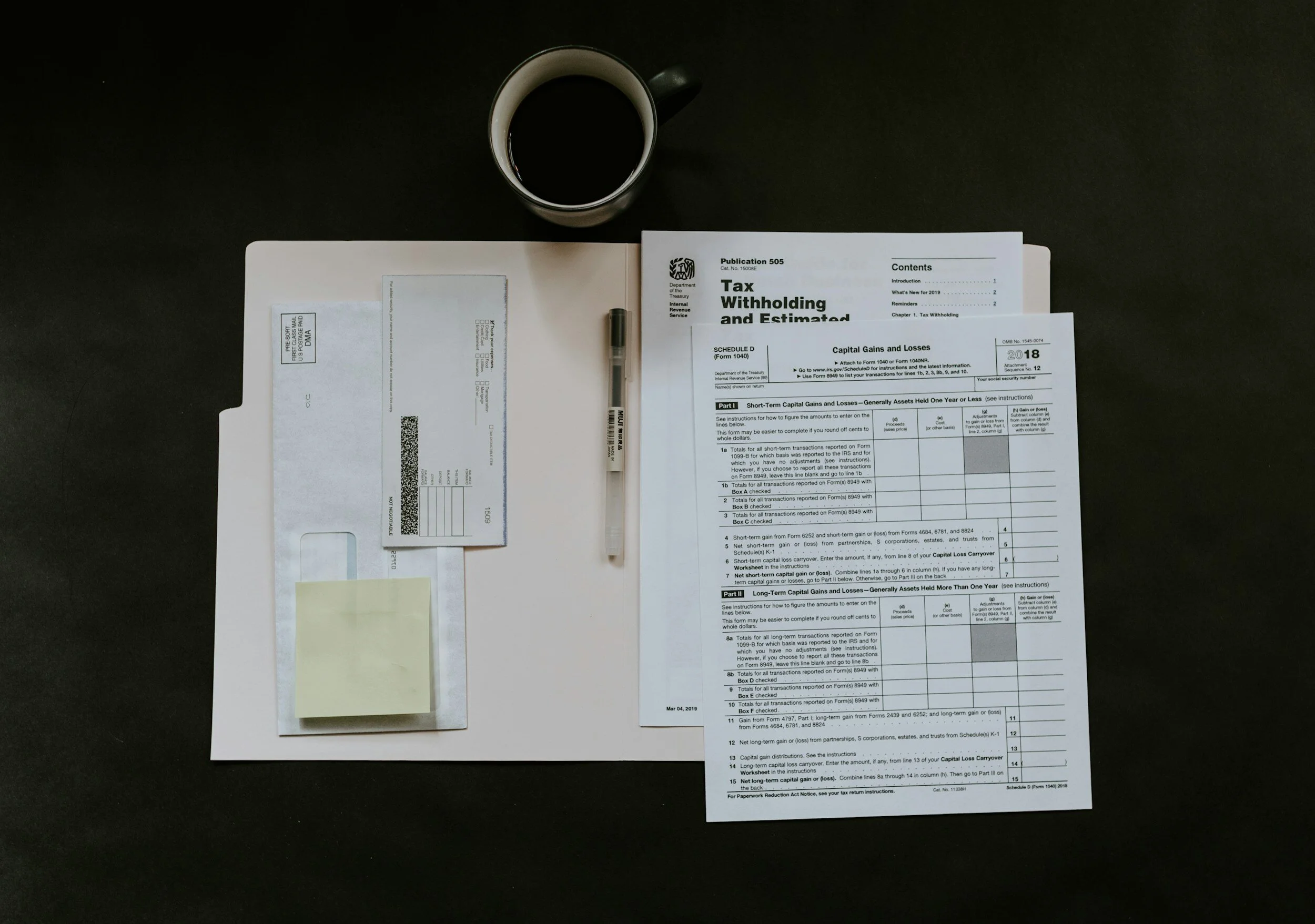

Deductions

It can be worth looking into potential deductions for blog-related expenses. A part of your home is dedicated to blogging and equipment purchases – these could be deductions that reduce your taxable income and mean you keep more of your profits.

Budgeting

Unlike traditional jobs, blogging income doesn't come with tax withholdings. So, you’ll need to set aside a portion regularly to cover potential tax obligations, avoiding surprises during tax season. Understanding and factoring taxes like Social Security and Medicare into your financial planning is key. This is a proactive approach that prevents a hefty tax bill in April.

If tax terminology feels like a foreign language, consider hiring a tax accountant to work for you. You provide them with your information and they’ll take care of the difficult stuff, just be sure to keep your information clear and easy to understand. This is where good record-keeping and using good software will come in.

Keep Learning

Tax regulations regularly evolve, so stay informed by reading updates or attending workshops. Continuous learning means you’re able to make informed financial decisions for your blog.

Try to Stay Calm

Taxes really can seem daunting, so take it step by step. Stay organized, study the basics, and don’t hesitate to seek assistance from an accountant. While there’s a fee for this, it can be worth it for your peace of mind.